Sensei's Morning Forecast: XRP Breaks All Time Highs, EU Hits Russia Hard, and More...

EU imposes energy and banking sanctions, XRP soars, Trump prepares crypto signing, India rejects NATO, crypto caps $4T, and altcoin rotation deep dive highlights smart money strategies.

🧠 One Big Thing

The global crypto market just crossed $4 trillion for the first time ever, powered by the U.S. passing its first federal stablecoin law — a regulatory milestone that’s redefining digital finance. This surge signals that crypto is rapidly moving from a speculative asset class to a regulated, institution-friendly market with growing mainstream traction.

💰 Money Move of the Day

Think of regulation as the bridge between niche tech and mainstream adoption. When rules bring clarity (like the GENIUS Act for stablecoins), it often sets the stage for larger players to step in — a trend worth observing closely.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $118,232 (▼ -0.34%)

Ethereum (ETH): $3,441 (▲ +2.05%)

XRP: $3.27 (▲ +7.64%)

Equity Indices (Futures):

S&P 500 (SPX): 6,263 (▲ +0.08%)

NASDAQ 100: 23,084 (▲ +0.03%)

FTSE 100: 8,970 (▼ -0.13%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.465% (▲ +0.13%)

Oil (WTI): $66.77 (▼ -0.07%)

Gold: $3,326 (▼ -0.65%)

🕒 Data as of

UK (BST): 12:27 / US (EST): 07:27 / Asia (Tokyo): 20:27

✅ 5 Things to Know Today

🇪🇺🇷🇺EU Unleashes 18th Sanctions Package Against Russia, Targeting Energy and Banking

The European Union approved its 18th sanctions package against Russia on Friday, with officials calling it one of the bloc's most powerful measures yet (Euronews; Reuters). The sanctions focus on crippling Russia's energy exports and banking sector in response to the ongoing war in Ukraine, with EU Foreign Policy Chief Kaja Kallas stating the bloc is "striking at the heart of Russia's war machine" (RFE/RL). A key component is the reduction of the G7 price cap on Russian crude oil from $60 to $47.60 per barrel, paired with a new dynamic pricing mechanism set at 15% below market rates, recalculated every six months (RBC Ukraine).

The sanctions also impose a ban on transactions with 22 more Russian banks, including a full SWIFT cutoff for institutions previously only partially restricted (The Moscow Times). Additionally, 105 new vessels from Russia's shadow fleet have been blacklisted, raising the total to over 400 ships (United24). For the first time, the EU sanctioned a foreign ship registry and Rosneft’s largest Indian refinery. Other measures include a transaction ban on Nord Stream 1 and 2 gas pipelines and sanctions on two Chinese banks accused of helping Moscow bypass existing restrictions (Anadolu Agency; Bloomberg).

Sensei’s Insight: Energy markets may see added volatility as the stricter price cap squeezes Russian crude revenues while reducing global supply flexibility. The banking restrictions further isolate Russia from international finance, accelerating its pivot toward alternative trade networks. Shadow fleet sanctions could tighten shipping capacity and push up freight and insurance costs, while sanctions on Chinese banks signal growing risks of secondary sanctions in Asia.

🚀XRP Broke All-Time Highs at $3.40 on Regulatory Breakthrough

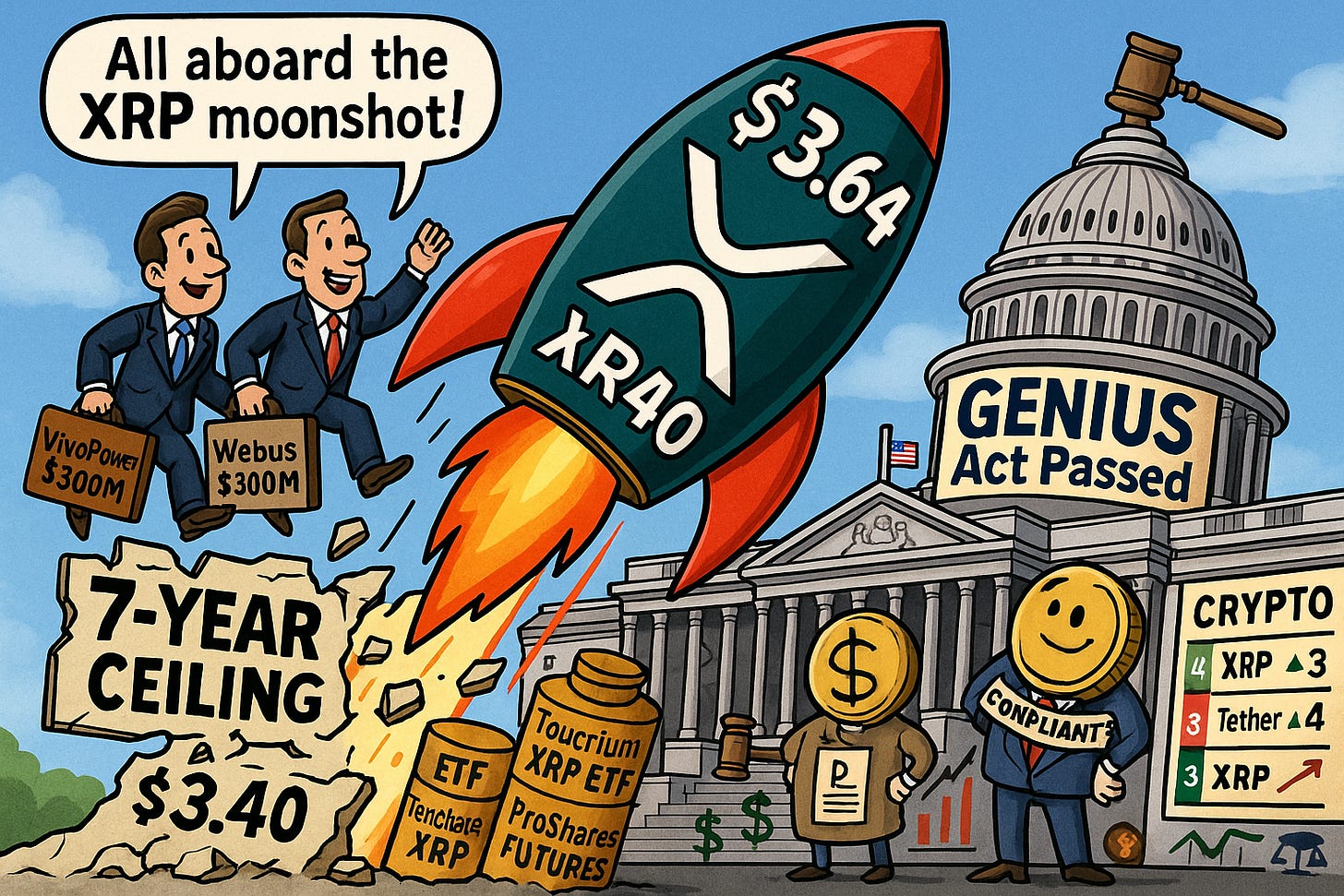

XRP surged to a record-breaking $3.64 on July 18, surpassing its previous peak of $3.40 set in January 2018 and pushing its market cap above $212 billion (crypto.news). The rally followed the House's passage of the GENIUS Act on July 17, a landmark bill establishing federal regulatory clarity for stablecoins with requirements for full reserve backing, audits, and licensing (Morgan Lewis; CNN). Ripple’s RLUSD stablecoin is already compliant with these provisions, positioning the company to benefit directly from the law’s implementation (Coindesk). Following the vote, XRP gained 18% within 24 hours as trading volumes surged 135% to $19.05 billion, while futures volume spiked 162% to $46.65 billion with open interest rising 27% to $11.11 billion (crypto.news).

Institutional adoption further fueled momentum. VivoPower International allocated $121 million from a recent Saudi-backed fundraise (FXStreet), while Chinese mobility startup Webus committed $300 million to build an XRP reserve for cross-border payments (Finance Magnates). Teucrium’s leveraged XRP ETF doubled in price this month, outpacing the firm’s agricultural products, while ProShares launched three new XRP futures funds to meet growing demand (DLNews). With XRP now the third-largest cryptocurrency by market cap, the GENIUS Act’s regulatory clarity, combined with corporate treasury adoption and expanding ETF access, has laid a robust foundation for continued institutional inflows (crypto.news). Ripple’s pursuit of a U.S. bank charter and a Federal Reserve master account could further integrate XRP into traditional finance (The Digital Banker).

Sensei’s Insight: XRP’s breakout above a seven-year ceiling signals that the crypto narrative is shifting from speculative hype to institutional-grade adoption. Regulatory clarity is no longer a future promise—it’s here, and Ripple is positioned as a direct beneficiary.

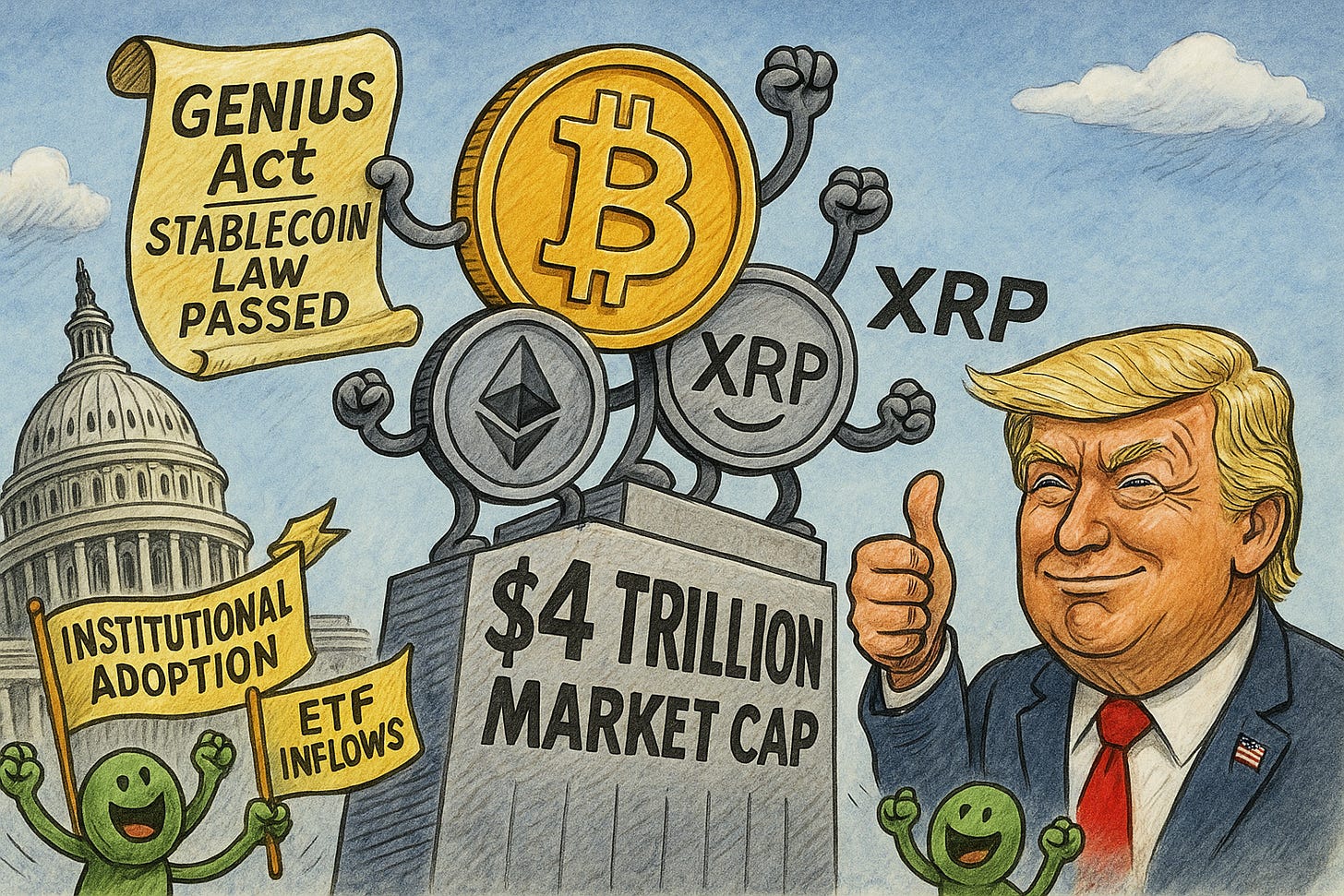

Crypto Market Value Surges Past $4 Trillion as US Passes Stablecoin Law

The total market capitalization of crypto assets surpassed $4 trillion for the first time, fueled by a broad altcoin rally and a landmark regulatory milestone. This jump followed the US House of Representatives’ approval of the “GENIUS Act” stablecoin bill on July 17, which passed 308-122, with President Trump signaling his support. Bitcoin traded at $120,134 (+1.7%), maintaining 59.9% market dominance at a $2.39 trillion cap, while Ether surged above $3,600 (+7.8%) and XRP hit a new all-time high at $3.62 (+20%) in the past 24 hours. Altcoins significantly outperformed, and inflows into US-listed crypto ETFs spiked, with Bitcoin funds adding $5.5 billion and Ethereum ETFs taking in $2.9 billion in July (Bloomberg) (The Block) (The Edge).

The GENIUS Act introduces the first federal regulatory framework for US dollar-pegged stablecoins, a $265 billion market. The law mandates 1:1 reserve backing, monthly disclosures, and establishes both federal and state oversight for issuers. Lawmakers hailed the bill as a “foundational” step in crypto policy, marking a key moment in the sector’s move toward mainstream financial integration. The legislation passed with strong bipartisan backing and now advances to the Senate, where broader market structure reforms are also under review (Reuters) (The Hill) (Reuters).

Sensei’s insight: The GENIUS Act is a watershed moment for crypto, bringing long-awaited regulatory clarity that could accelerate institutional adoption. While the rally highlights bullish sentiment, the sector remains highly volatile, and investors should closely track Senate deliberations and regulatory rollouts.

Trump Set to Sign Historic Crypto Legislation as GENIUS Act Heads to White House

The U.S. House of Representatives passed the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) on Thursday with bipartisan support, marking the first comprehensive federal cryptocurrency legislation in American history (Al Jazeera; Morningstar). The bill cleared the House 308-122 with backing from over 100 Democrats and heads to President Donald Trump’s desk following Senate approval in June by a 68-30 vote (CoinCentral). The White House confirmed a signing ceremony for Friday, July 18, at 2:30 PM ET, with industry leaders and lawmakers expected to attend. Press Secretary Karoline Leavitt said the law will “make America the crypto capital of the world,” aligning with Trump’s campaign promises (CryptoBriefing; Bitcoin Magazine).

The GENIUS Act establishes federal oversight for the $264 billion stablecoin market, mandating that issuers back tokens with liquid assets such as U.S. dollars and Treasury bills, alongside monthly reserve disclosures (Reuters; DailyCoin). Its passage coincided with the cryptocurrency market cap surpassing $4 trillion, as Bitcoin approached $120,000 and Ethereum crossed $3,400 (Mitrade). The bipartisan support, including nearly 40% of House Democrats, suggests momentum for additional legislation such as the CLARITY Act, which is advancing in the Senate (NYT). Regulatory clarity is already fueling institutional inflows, with Bitcoin ETFs seeing $2.02 billion in new investments this week alone, though critics warn the framework could be overly permissive and benefit Trump-linked ventures like World Liberty Financial’s stablecoin (Al Jazeera).

Sensei’s Insight: A U.S. president signing the first major crypto law is a watershed moment. The GENIUS Act sets the tone for global stablecoin regulation, with potential ripple effects across traditional finance and digital asset adoption.

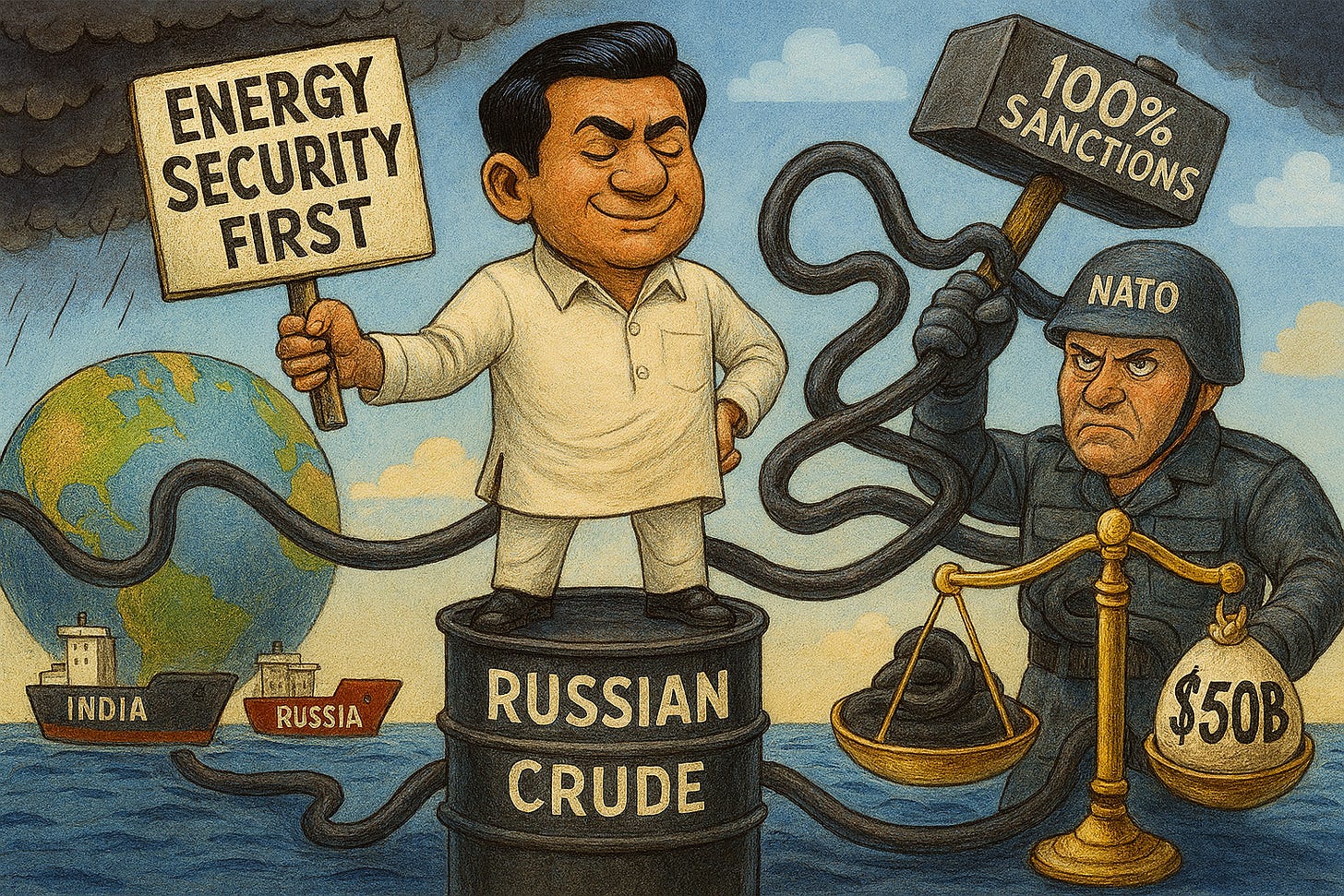

India Rejects NATO's 100% Sanctions Threat Over Russian Energy Trade

India has firmly rejected NATO Secretary General Mark Rutte’s warning of potential 100% secondary sanctions against nations continuing energy trade with Russia, emphasizing its commitment to energy security over Western pressure. The confrontation intensified Thursday when India’s Ministry of External Affairs dismissed Rutte’s remarks targeting India, China, and Brazil. MEA spokesperson Randhir Jaiswal stated that “securing energy needs of our people is understandably an overriding priority for us,” cautioning against Western “double standards” (Hindustan Times, Shipping Telegraph). Oil Minister Hardeep Singh Puri added, “I’m not worried at all. If something happens, we’ll deal with it” (Reuters). Rutte’s threat, issued after meeting U.S. senators, explicitly targeted the three nations, warning that continued Russian energy purchases would trigger “100% secondary sanctions” (Economic Times, Indian Express). This aligns with former U.S. President Trump’s 50-day ultimatum demanding a Ukraine peace deal or severe tariffs and sanctions on Russian export buyers (Al Jazeera, ABC News).

India’s imports of Russian crude hit an 11-month high of 2.08 million barrels per day in June 2025, representing 40% of total oil imports—valued at over $50 billion for FY2024-25 (AINvest, Silicon India). This marks a stark rise from less than 2% pre-2022 (Reuters, Indian Express). Despite a 6% decline in overall imports, Russian shipments rose 8% month-on-month (Economic Times). Secondary sanctions could force a costly realignment of India’s $143 billion annual oil imports, likely boosting Middle Eastern suppliers such as Iraq and Saudi Arabia while adding $4–5 per barrel in costs compared to discounted Russian crude (Times of India). Analysts warn this could stoke inflationary pressures, affecting energy-intensive sectors and economic growth.

Sensei’s Insight: India is drawing a firm red line on energy sovereignty. Any sanctions forcing a supply shift will ripple through global oil markets and test New Delhi’s balancing act between cost efficiency and geopolitical alignment.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: Altcoins Analysis for XRP Profit Rotation: Deep Dive Market Intelligence

XRP’s strong performance has sparked increased attention on how profits from its rally may flow into other altcoins. This Deep Dive highlights seven tokens with close ties or strategic overlaps with XRP, examining their fundamentals, market positioning, and potential to benefit from upcoming rotation trends

Keep reading with a 7-day free trial

Subscribe to Sensei’s Insights to keep reading this post and get 7 days of free access to the full post archives.